A candid meeting of minds about subjects varying from making money in the markets to the vagaries of the human psyche to the philosophical aspects of man and much more...

Saturday, January 22, 2011

Thursday, January 6, 2011

Meeting Minutes

We had an indicative and opportunistic meeting today at Chili’s! We had a total of 5 attendees: (from left to right) Kevin Day, Jeff Harrington, Andrew Whatley, Elena Swindull, and VJ Arjan (not sure what’s going on with the eyes :-) ).

2010 - A Year In Review

We started the year discussing what has occurred in the past year and how we have all profited enormously. Regular investment themes on the Scarlet Kings like commodities and emerging markets have surged, some making fresh highs in 2010.

Here were the top 5 performing markets by country (not surprisingly all of them are emerging markets):

1. Indonesia – 54.9%

2. Thailand – 54.3%

3. Chile – 47.9%

4. Colombia – 44.0%

5. Argentina – 41.3%

Kevin Day explained how small caps have done very well, in particular junior miners (i.e. GDXJ – Market Vectors Junior Gold Miners ETF). Of the precious metals silver’s gains far outpaced gold, and Kevin believes that this will continue in 2011 as well.

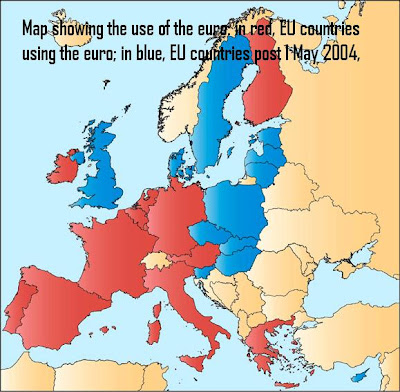

The Euro

Famous fund manager, Louis Navellier, recently posted an article on his blog stipulating that as the euro turned 15 years old on December 16th, will it survive to be 20?

Interestingly enough the top performing European economies were outside the Eurozone, with the exception of the very fiscally strong Germany, while the worst European economies were the PIIGS, with the exception of Norway.

Top 6 European economies: Turkey, Sweden, Poland, Germany*, Switzerland, and Denmark

Bottom 6 European economies: Greece, Ireland, Norway*, Spain, Portugal, and Italy

So this begs the question if the Euro constitutes any real benefit at all. In fact, Jeff Harrington explained how there is talk that the very strong Germany should indeed pull out of the Eurozone and go back to issuing Deutchmarks. This alone could collapse the house of cards. But according to Navallier, Germany may try to rescue this economic union out of a misplaced sense of duty:

“Europe has struggled for the last 65 years to bury their hatchets and form some kind of mutually-beneficial economic union. But unlike the United States, Europe is still a welter of sovereign states, with different languages and economies, joined loosely by their common coin, but with ancient rivalries beneath a thin veneer of courtly civility.”

VJ Arjan related that the economic differences within the Eurozone are exacerbated by the fact that not only each country, but each county within each country generally has a different tax code.

Kevin Day has even reverted to a previous inclination that this may be the year that we see the Euro on parity with the dollar.

The Greenback

Most likely, short of lighting one’s assets on fire, the U.S. dollar has taken a bloodbath not only against other major currencies, but also against hard assets, like ferrous and non-ferrous commodities.

But, Kevin Day believes that the coming year will fare well for the U.S. dollar although mostly against the major currencies. He still believes that commodities, including precious metals, will continue to appreciate.

The New Congress

We now have a less partisan Congress, with Republican John Boehner as speaker. He has previously publicly spoken about the need to reduce the national deficit and we hope that he is serious about this. These policies, if put in place, will obviously be positive for the U.S. dollar as austerity measures will curb government deficit spending and will also make the Fed stop its printing presses.

Kevin Day believes that the recent healthcare bill ratified by President Obama will be repealed and that there will begin some severe austerity measures.

What To Expect in 2011

Kevin Day’s famous “Market Nose” tells him that the economy should be on track toward recovery until at least the end of Q1 this year. After that he cannot see.

Here are some other highlights:

· The shoe for commercial real estate is still one that must drop and he thinks that this possible may hit during the latter part of this year.

· Commodities, particularly precious metals, are still going to be investment favourites.

· In particular, Kevin feels that mid-cap stocks will perform very well; one way to get exposure to this is to pick up the Russell 2000 ETF (IWM – iShares Russell 2000).

· Emerging markets can be picked up by taking a position in the Vanguard Emerging Markets ETF (VWO). The great thing about Vanguard no-load funds, for the most part, is their very low administrative fee structure. He also likes the China (CHN) and Taiwan (TWN) funds.

· Some blue chips that are trading at favourable prices include: Ford (F), General Mills (GIS), and Citigroup (C).

· Something Jeff Harrington called during the middle of last year, it may be prudent to start nibbling on some natural gas as it looks poised for a break to the upside. Ways one can take advantage of this play: Kinder Morgan Energy Partners LP (KMP), Chesapeake Energy (CHK), Devon Energy (DVN).

Kevin Day’s “Market Nose”

Elena Swindull asked a Kevin Day how he decides to pick the stock he picks and here’s what Kevin had to say:

- Earnings per share (EPS) – Kevin takes a fundamental analysis approach to picking his stocks and particularly likes companies whose cash flow puts them in more favourable conditions. He has claimed his love of reading balance sheets and truly enjoys hunting for those bargains.

- Volume – Historically, for major moves, price has nearly always followed volume.

- Entry point - See where the stock has traded in the last 90 days. This can give the investor a point to pick for an entry.

Speculative Plays

Kevin Day has offered these two speculative plays for the coming year. For those who have invested in Santa Fe Gold Corporation and for all those who have followed Kevin’s plays in the past know that when this man speaks, it is prudent to listen.

Razor Resources Inc. (RZOR) - small cap miner engaged in acquisition of mineral rights and exploration of mineral property in Honduras. In March 2010, the company completed the acquisition of 99% of Compania Minera Cerros Del Sur, S.A., which owns gold mining concessions and producing gold mines covering 200 hectares in Honduras.

Razor Resources Inc. (RZOR) - small cap miner engaged in acquisition of mineral rights and exploration of mineral property in Honduras. In March 2010, the company completed the acquisition of 99% of Compania Minera Cerros Del Sur, S.A., which owns gold mining concessions and producing gold mines covering 200 hectares in Honduras.

AEterna Zentaris Inc. (AEZS) -

Simulated Portfolio

Date Security Entry (Oct 08) Current Price Profit/Loss January 2nd, 2011 FXI (iShares FTSE/Xinhua China25 Index $25.16 $43.97 $1,881 January 2nd, 2011 ILF(iShares S&P Latin America 40 Index) $26.60 $53.49 $2,689 January 2nd, 2011 EWZ(iShares MSCIBrazilIndex) $37.69 $76.78 $3,909 January 2nd, 2011 PBJ(PowerShares Dynamic Food & Beverage) $13.27 $18.09 $482 January 2nd, 2011 GUR (SPDR S&P Emerging Europe) $29.74 $50.57 $2,083 January 2nd, 2011 FCX (Freeport-McMoRan Copper & Gold Inc.) $29.06 $116.08 $8,702 January 2nd, 2011 WLT (Walter Industries – metallurgical coal) $38.75 $135.49 $9,674 January 2nd, 2011 VALE (Companhia Vale do Rio Doce – gold mining) $13.12 $35.13 $2,201 January 2nd, 2011 GVA (Granite Construction Inc.) $35.67 $26.24 -$943 January 2nd, 2011 MT (Arcelor-Mittal ADR) $26.25 $35.89 $964

*Positions entered in December 2008

The next meeting will be on Sunday, January 30th, 2011. I will be out of the country for most of February so I figure we could at least have our meeting on the last Sunday of this month. My sincerest apologies to anyone this may inconvenience. For those who have not attended a meeting, but would like to attend, please email your wish to VJ Arjan at scarletkings@gmail.com